Eitc 2024 Income Limits

Eitc 2024 Income Limits. The amounts from tables 1 and 2 are added to wages solely for calculating income tax withholding on the wages of the nonresident alien employee. Washington — the internal revenue service and partners around the nation today launched the annual earned income tax credit awareness day outreach.

To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and credit limits for the current, previous and upcoming tax years. In 2023, your investment income is capped at $11,000, while in 2024, the limit increases to $11,600.

For Workers With Qualifying Children, The 2023 Earned Income Credit Can Be Worth Up To $7,430 ($7,830 For 2024).

To qualify for the eitc for the 2023 tax year, your birthday must be.

How Much Is The Earned Income Tax Credit?

Free file helps millions of taxpayers each year to file tax returns for free and this.

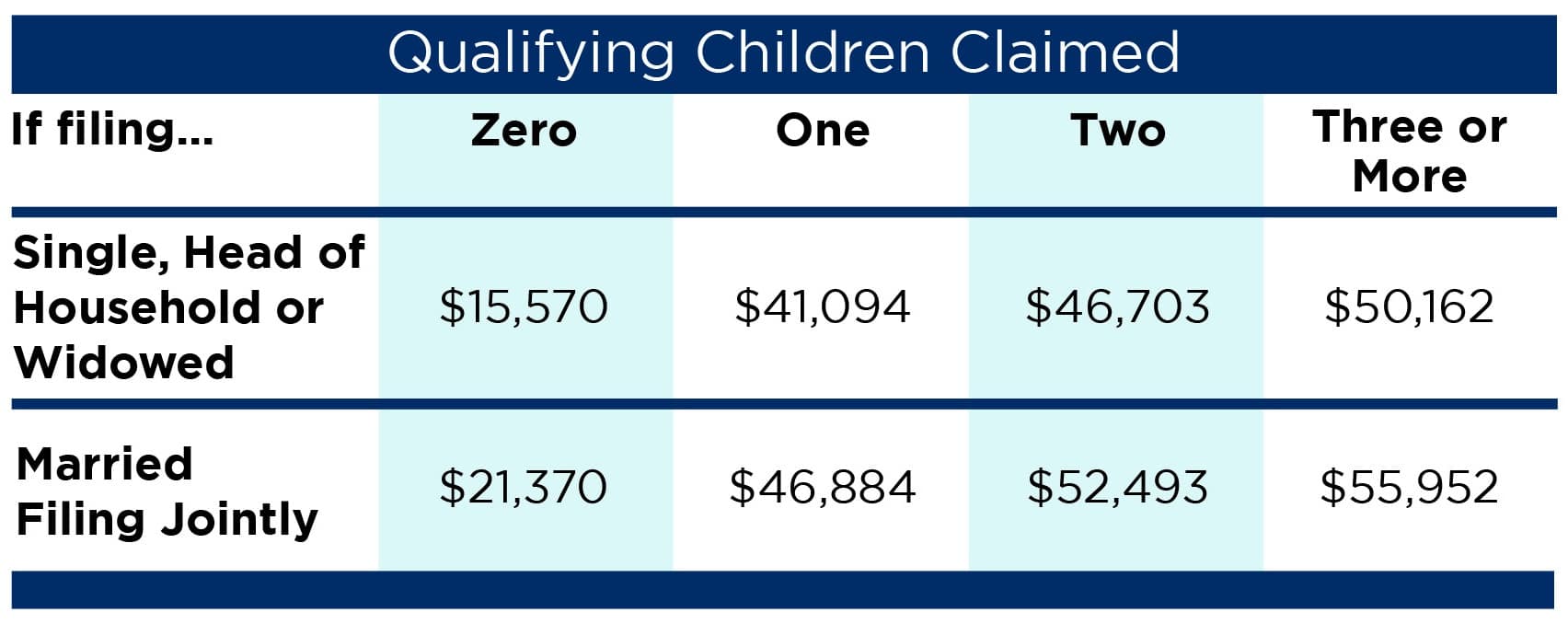

Limits On Income For The 2023 Tax Year Are:

Images References :

Source: detroitmi.gov

Source: detroitmi.gov

Earned Tax Credit City of Detroit, In 2023, your investment income is capped at $11,000, while in 2024, the limit increases to $11,600. To qualify for the eitc for the 2023 tax year, your birthday must be.

Source: boxelderconsulting.com

Source: boxelderconsulting.com

2023 Tax Bracket Changes and IRS Annual Inflation Adjustments, For tax year 2023, the child tax credit is $2,000 per child, age 16 or younger. In 2024, the earned income tax credit (eitc) will offer varying amounts, ranging from $632 to $7,830, depending on filing status and the number of children,.

Source: taxfoundation.org

Source: taxfoundation.org

Earned Tax Credit? (EITC) Definition TaxEDU, Have investment income below $11,000 in the tax year 2023. The amounts from tables 1 and 2 are added to wages solely for calculating income tax withholding on the wages of the nonresident alien employee.

Source: gbq.com

Source: gbq.com

Earned Credit Limitation Tax Reform Changes Ohio CPA, To qualify for the eitc for the 2023 tax year, your birthday must be. The amounts from tables 1 and 2 are added to wages solely for calculating income tax withholding on the wages of the nonresident alien employee.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, People who earned $63,398 or less in 2023 may be eligible for this valuable tax credit. Working families with modest incomes may qualify for the earned income tax credit (eitc) of up to $7,430.

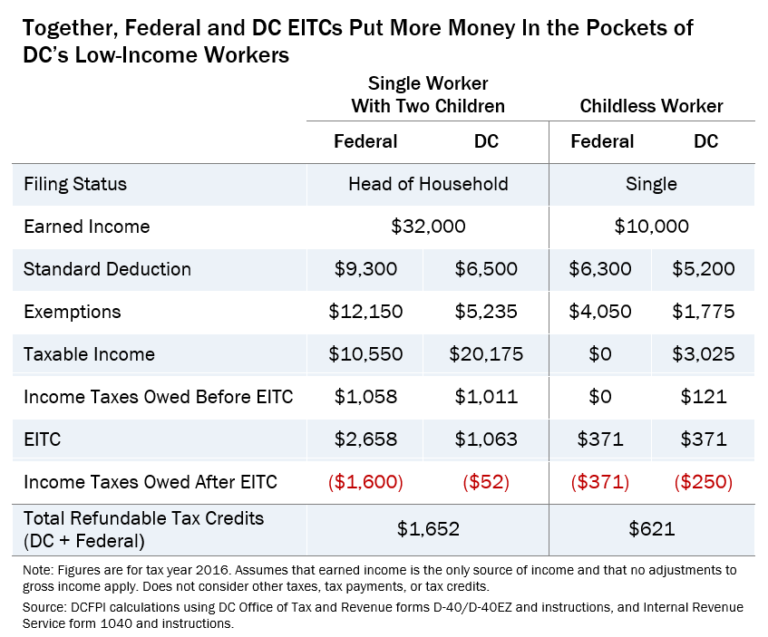

Source: www.dcfpi.org

Source: www.dcfpi.org

DC’s Earned Tax Credit, Eligibility for the eitc in 2024 is determined based on income limits, filing status, and the presence of qualifying children. In 2024, the earned income tax credit (eitc) will offer varying amounts, ranging from $632 to $7,830, depending on filing status and the number of children,.

Source: www.nalandaopenuniversity.com

Source: www.nalandaopenuniversity.com

Earned Tax Credit 2024 EITC Eligibility, Fill Online irs.gov, For tax year 2023 and 2024, the maximum income limit for single filers will be $56,838 with three dependents. And finally, their investment income must be $3,650 or less for the year.

Source: cwccareers.in

Source: cwccareers.in

600 Earned Tax Credit 2024 Know Limit & EITC Refunds Date, Use the eitc tables to look up maximum credit amounts by. The amount of eitc that a taxpayer can claim depends on their income, filing status, and the number of qualifying.

Source: www.pgpf.org

Source: www.pgpf.org

What Is the Earned Tax Credit?, For married couples filing jointly, the maximum income limit. $53,057 ($59,187 married filing jointly) with three or more qualifying children.

What to expect for the 2024 tax filing season, Have worked and earned income under $63,398. Have investment income below $11,000 in the tax year 2023.

Claiming The Credit Can Reduce The Tax You Owe And May Also Give You.

Limits on income for the 2023 tax year are:

To Qualify For The Eitc For The 2023 Tax Year, Your Birthday Must Be.

It’s also subject to phase out as income rises, starting at $400,000 for joint filers.